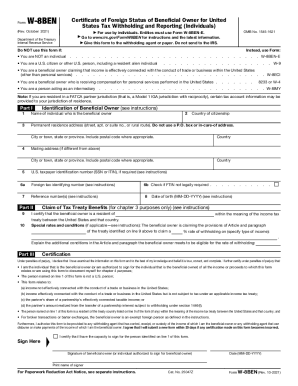

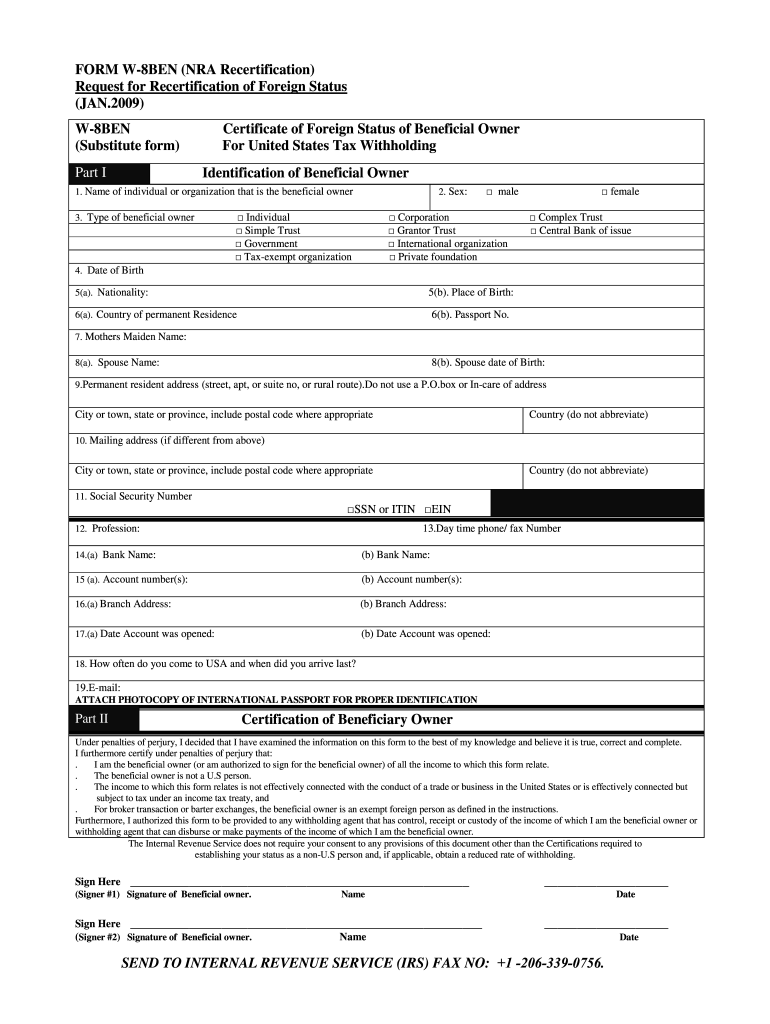

IRS W-8BEN Substitute Form 2009-2026 free printable template

Instructions and Help about IRS W-8BEN Substitute Form

How to edit IRS W-8BEN Substitute Form

How to fill out IRS W-8BEN Substitute Form

Latest updates to IRS W-8BEN Substitute Form

All You Need to Know About IRS W-8BEN Substitute Form

What is IRS W-8BEN Substitute Form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-8BEN Substitute Form

What should I do if I notice a mistake after submitting the IRS W-8BEN Substitute Form?

If you realize there's an error after submission, you should promptly submit a corrected IRS W-8BEN Substitute Form. Ensure to clearly mark it as a correction and provide an explanation of the error, which will help in processing. Keeping records of both the original and corrected forms is essential for accurate tracking.

How can I verify if my IRS W-8BEN Substitute Form has been received and processed?

To confirm the status of your IRS W-8BEN Substitute Form, you can contact the financial institution or payer to which you submitted the form. They should provide you with information on whether it has been received and if any issues arose during processing.

What are common errors associated with the IRS W-8BEN Substitute Form, and how can I avoid them?

Common errors include incorrect taxpayer identification numbers and missing signatures. To avoid these, always double-check your entries against official documents before submission. Also, ensure you're familiar with the specific requirements related to nonresidents or foreign payees to minimize mistakes.

Can I e-file the IRS W-8BEN Substitute Form, and what technical requirements should I be aware of?

Yes, you can e-file the IRS W-8BEN Substitute Form, but make sure your e-filing software is compatible with IRS requirements. It’s important to use updated browsers and internet connections to prevent errors during the submission process.